Forex Crunch USD/JPY: Trading the ISM Manufacturing PMI |

- USD/JPY: Trading the ISM Manufacturing PMI

- EUR/USD April 30 – Steady as Eurozone Unemployment Hits New Record

- Big fall in euro-zone inflation adds pressure for a rate cut

- Traders begin positioning themselves ahed of FED, ECB

- Turning the yen around

- Forex Daily Outlook April 30 2013

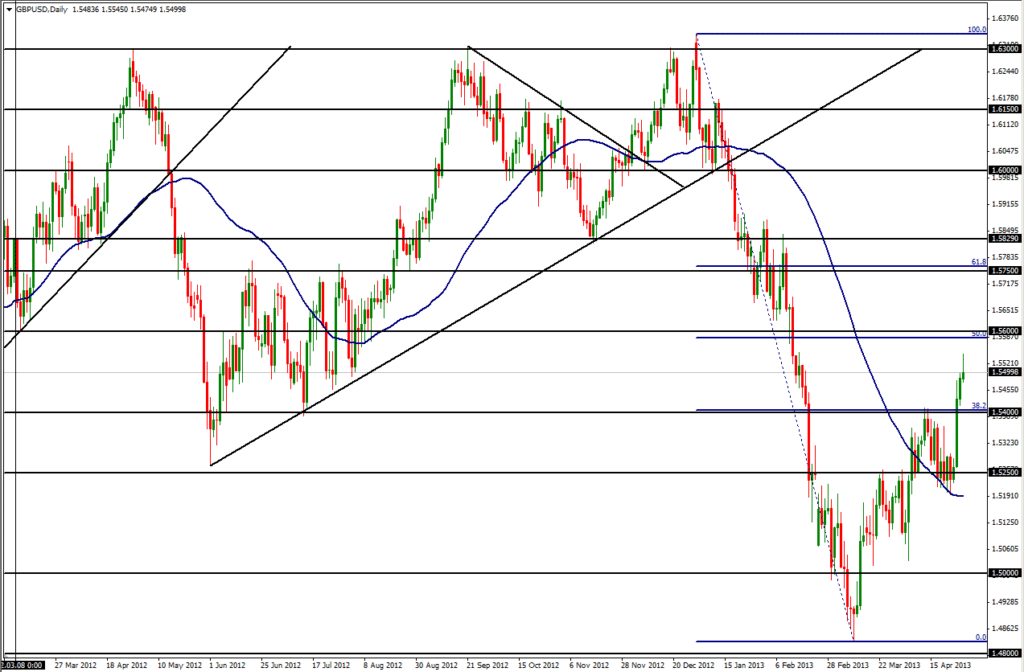

- Forex Analysis: GBP/USD Attempts to Continue Upside Recovery

- US Pending Home Sales Rise 1.5%, USD/JPY Breaks Higher

| USD/JPY: Trading the ISM Manufacturing PMI Posted: 30 Apr 2013 03:50 AM PDT The ISM Non-Manufacturing PMI (Purchasing Managers' Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Read the rest of the article USD/JPY: Trading the ISM Manufacturing PMI |

| EUR/USD April 30 – Steady as Eurozone Unemployment Hits New Record Posted: 30 Apr 2013 03:40 AM PDT EUR/USD is steady in Tuesday trading, as the pair trades in the high-1.30 range in the European session. The Eurozone unemployment rate hit another record, stoking further speculation that the ECB may take action and lower interest rates later this week. German data was a mixed bag, as Unemployment Change was higher than expected, while Consumer Consumer Climate beat the forecast. In the US, today’s major event is CB Consumer Climate. The markets are anticipating a turnaround in the indicator after last month’s weak release. Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar. Read the rest of the article EUR/USD April 30 – Steady as Eurozone Unemployment Hits New Record |

| Big fall in euro-zone inflation adds pressure for a rate cut Posted: 30 Apr 2013 02:05 AM PDT According to the CPI Flash Estimate, euro-zone headline CPI fell from 1.7% to 1.2%, significantly below the 1.6% estimation and far off the 2% inflation target. This figure, together with another rise in unemployment, adds pressure for the ECB to act and cut the interest rate, even though this move would have more of a symbolic impact than a real impact on borrowing. Read the rest of the article Big fall in euro-zone inflation adds pressure for a rate cut |

| Traders begin positioning themselves ahed of FED, ECB Posted: 30 Apr 2013 02:01 AM PDT The EUR began the overnight trading session on a firm basis after Italy's new Prime MInister Letta won his first confidence vote in the lower house by a vote of 453 to 153. The new government is finding backing not only from Letta's center-left Democratic Party, but also from Berlusconi's center-right People of Freedom party and by former Prime Minister Monti. Letta is expected to win another vote on Tuesday in Italy's senate. The EUR tested resistance overnight at the 1.3120 level. Read the rest of the article Traders begin positioning themselves ahed of FED, ECB |

| Posted: 30 Apr 2013 01:15 AM PDT USD: The main focus will be with the consumer confidence data at 14:00 GMT. Last release saw the headline reading fall to 59.7, with the market looking for a small rebound to 61.0. Dollar has been more resilient to weaker US data recently, partly owing to weaker than expected readings in non-US data. EUR: After the weaker survey data last week, focus on the German labour market numbers. Weakening here could further seal an ECB rate cut this week. Unemployment rate is seen steady at 6.9%. Eurozone inflation is expected softer from previous 1.7%. Read the rest of the article Turning the yen around |

| Forex Daily Outlook April 30 2013 Posted: 29 Apr 2013 02:00 PM PDT CB Consumer Confidence in the US and GDP in Canada are the main events lined up. Let’s see what awaits us today. In the US, The Conference Board (CB), Consumer Confidence survey to value the current and future financial conditions like labor availability and overall economic situation, rise up to 60.6 points from 59.7 points on the last month is due. Read the rest of the article Forex Daily Outlook April 30 2013 |

| Forex Analysis: GBP/USD Attempts to Continue Upside Recovery Posted: 29 Apr 2013 07:29 AM PDT April 29, 2013 – GBP/USD (daily chart) has attempted to continue its upside recovery from late last week, when price broke out cleanly above key resistance in the 1.5400 price region. This previous resistance level was also around the 38.2% Fibonacci retracement of the long plummet from the 1.6337 high in the very beginning of the year to the 1.4830 low in mid-March. After having broken out above 1.5400 last Thursday, the following day saw a continuation of the upside momentum. This week, Monday's price action saw a high at 1.5545 before pulling back to the downside. Read the rest of the article Forex Analysis: GBP/USD Attempts to Continue Upside Recovery |

| US Pending Home Sales Rise 1.5%, USD/JPY Breaks Higher Posted: 29 Apr 2013 07:06 AM PDT US pending home sales rose by 1.5% in March. They were were expected to rise by 1.1% after a drop of 0.4% in February. Year over year, sales rose by 7%, better than 6.1% that was expected. The housing sector was a significant driver of the economic recovery, but recent figures haven’t been too good. Read the rest of the article US Pending Home Sales Rise 1.5%, USD/JPY Breaks Higher |

| You are subscribed to email updates from Forex Crunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment