Forex Crunch EUR/USD May 1 – Charges Higher Ahead of Fed Meeting |

- EUR/USD May 1 – Charges Higher Ahead of Fed Meeting

- GBP/USD Unable to Break Resistance Despite Upbeat Manufacturing PMI

- Dollar Under Pressure Ahead of the Fed

- The declining dollar

- Forex Crunch Key Metrics April 2013

- Forex Daily Outlook May 1 2013

- AUD/USD: Trading the Australian Building Approvals

- ECB unlikely to introduce negative interest rates

- Dollar Fell Across the Board Towards the Fix – Partially Fixed

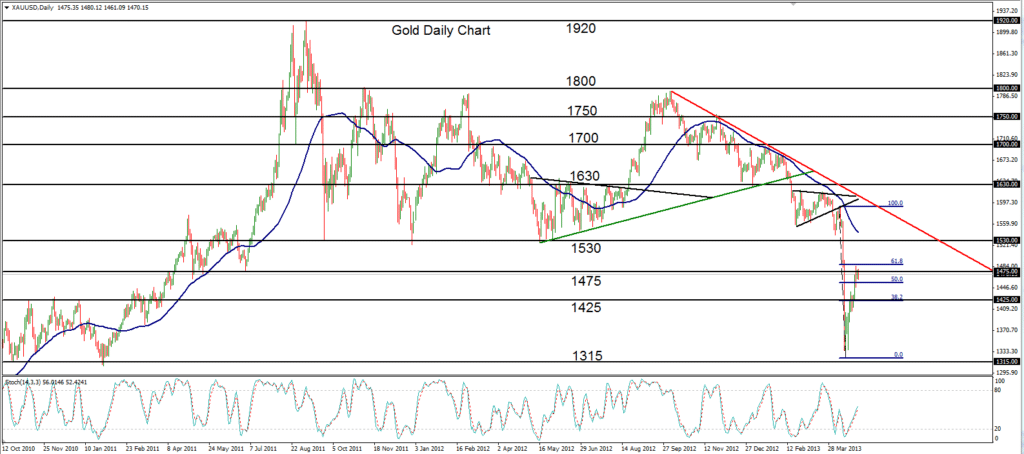

- Gold Extends Recovery to 61.8% Level

| EUR/USD May 1 – Charges Higher Ahead of Fed Meeting Posted: 01 May 2013 03:46 AM PDT EUR/USD continues to move upwards on Wednesday. The pair was testing the 1.32 line in the European session, as the US dollar continues to weaken. In the US, the markets will be hoping for good news from ADP Non-Farm Employment Change and the ISM Manufacturing PMI. This will be followed by the FOMC Statement at the Federal Reserve Policy Meeting. In Europe, the markets are closed for the May 1 holiday. Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar. Read the rest of the article EUR/USD May 1 – Charges Higher Ahead of Fed Meeting |

| GBP/USD Unable to Break Resistance Despite Upbeat Manufacturing PMI Posted: 01 May 2013 03:43 AM PDT Manufacturing PMI in the UK exceeded expectations and rose from 48.6 to 49.8 points. No change was expected. GBP/USD was able to climb to higher ground and reach 1.5590 but couldn’t make it to 1.56, which served as a support line many times in the past, and now works as resistance. Read the rest of the article GBP/USD Unable to Break Resistance Despite Upbeat Manufacturing PMI |

| Dollar Under Pressure Ahead of the Fed Posted: 01 May 2013 02:26 AM PDT The USD remained under pressure overnight as the market awaits the end of the FOMC meeting and their rate decision. Traders looked towards yesterday's release of Chicago PMI and their concern had to do with the fact that the number unexpectedly dropped into contraction territory for the first time in over three years. This release negated the positive feeling of recent economic data that had raised expectation that the FED might start to cut the amount of QE being executed sooner rather than later. Read the rest of the article Dollar Under Pressure Ahead of the Fed |

| Posted: 01 May 2013 12:46 AM PDT GBP: Strong focus on the manufacturing PMI data and with liquidity lower owing to the holiday in many European countries, there is the risk of some outsized moves in sterling. The market looks for 48.5 reading and anything above the 50 level would be very welcome and would place a decent bid under sterling. Note that BoE members Broadbent and Bailey speak at 17:00 and 19:00 GMT respectively. USD: The FOMC meeting decision at 18:00 GMT will be a case of scanning the statement for any shift in language or tone. We doubt that there will be anything beyond subtle shifts in the description of the economy, with the more important language on policy remaining unchanged. Dollar volatility should be limited, but with a risk of modest gains. Read the rest of the article The declining dollar |

| Forex Crunch Key Metrics April 2013 Posted: 01 May 2013 12:14 AM PDT After a record month in March, April saw traffic that was lower than the record, but still very high in comparison to all the previous months. Some pairs such as the popular EUR/USD saw lower volatility. Read the rest of the article Forex Crunch Key Metrics April 2013 |

| Forex Daily Outlook May 1 2013 Posted: 30 Apr 2013 02:00 PM PDT ADP Non-Farm Employment Change in the US and Manufacturing PMI in the UK are the main events today. Here is an outlook on the market-movers awaiting us In the US, Automatic Data Processing, Inc. (ADP) Non-Farm Employment Change, VALUE THE employed people (not including the farming industry and government) over the last month, 154K is due from 158K on April. Read the rest of the article Forex Daily Outlook May 1 2013 |

| AUD/USD: Trading the Australian Building Approvals Posted: 30 Apr 2013 01:42 PM PDT Australian Buildings Approvals measures the change in the number of new building approvals issued. It is one of the most important indicators of the construction sector. A reading that is higher than the market prediction is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Read the rest of the article AUD/USD: Trading the Australian Building Approvals |

| ECB unlikely to introduce negative interest rates Posted: 30 Apr 2013 08:38 AM PDT The German Bundesbank and Mario Draghi have reservations regarding negative interest rates, that would punish strong banks, says Simon Smith of FxPro. In the interview below, Smith also discusses the lower yields in the euro-zone, how the sequester has yet to hit the US economy, and other topics. Read the rest of the article ECB unlikely to introduce negative interest rates |

| Dollar Fell Across the Board Towards the Fix – Partially Fixed Posted: 30 Apr 2013 08:01 AM PDT EUR/USD is approaching the 1.32 line, GBP/USD is the highest in a month, USD/CAD is close to parity and other currencies are also celebrating against the dollar. The US posted more positive than negative figures today. CB Consumer confidence exceeded expectations by jumping to 68.1 points, significantly better than 61.4 that was expected. On the other hand, the Chicago PMI dropped to contraction territory, 49 points instead of 52.5 expected. Read the rest of the article Dollar Fell Across the Board Towards the Fix – Partially Fixed |

| Gold Extends Recovery to 61.8% Level Posted: 30 Apr 2013 06:55 AM PDT April 30, 2013 – Gold (daily chart) has extended its recovery to the 61.8% Fibonacci retracement level of the precipitous price drop that occurred over just a few days in mid-April. After the drop to more than a 2-year low around 1320, price began its sharp recovery just two weeks ago, climbing back up above key support/resistance levels including 1425 – the 38.2% Fibonacci retracement of the drop. Price then climbed further to find itself now bumping up against key resistance around both the 1475 price level and the 61.8% Fibonacci retracement level. If price is able to further its recovery above this current resistance, major resistance further to the upside resides around 1530, which has long served as a key support level. A turn back to the downside after the current bullish correction within the current bearish trend has downside support objectives around 1425 and 1320 once again. Read the rest of the article Gold Extends Recovery to 61.8% Level |

| You are subscribed to email updates from Forex Crunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment